Selling tax credits to be highly transactable

How to sell tax credits to be highly transactable in an increasingly competitive market

The market for transferable tax credits is taking off and becoming more transparent and competitive. Expanded clean energy tax credits, coupled with more efficient monetization pathways, are fueling the energy transition.

Crux’s 2024 Mid-Year Market Intelligence Report found the overall volume of tax credit transactions in the first half of the year was between $9-11B. The data suggest the market will continue to accelerate, reaching $20-25B by the end of 2024.

Crux has observed that a certain subset of tax credits are in particularly high demand — these credits tend to receive bids within days of listing, receive multiple bids, and transact within a matter of a few weeks. To date, these highly transactable tax credits have been defined, by the notional deal size and technology of the credit.

In the first half of 2024, Crux found that highly transactable credits made up a very large share of the market: 95% of reported deals in the first half of the year were for wind, utility-scale solar and/or storage, and advanced manufacturing production tax credits.

Demand for tax credits is growing quickly, and buyers are becoming increasingly sophisticated in their approach to tax credit transactions. As a result, the market is also becoming increasingly competitive. Two-thirds of market participants are engaging in some form of competition. A large and liquid tax credits marketplace supports deal discovery and ensures that buyers can prioritize credits that meet their needs.

As competition increases for selling tax credits, standing out is imperative for sellers. The data show that there are common actions every project developer and manufacturer can take to make their credits more appealing, ultimately generating more bids and maximizing their value.

Selling tax credits more effectively: 3 actions

1. Market yourself

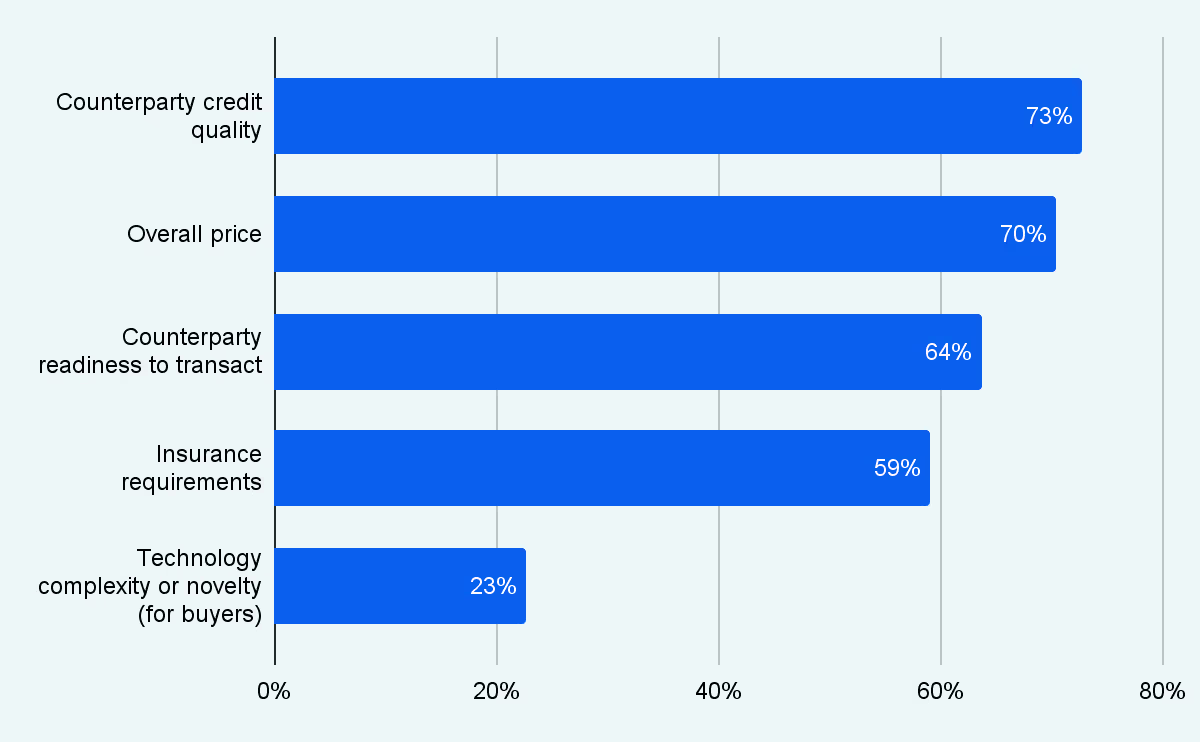

Crux’s data show tax credit buyers are increasingly looking for experienced sellers, and strong insurance or parent indemnification when evaluating developers and manufacturers. 73% of buyers and advisors prioritize counterparty credit quality when selecting credits to bid on, making this the most important factor for how to sell tax credits evaluated by buyers.

Factors considered by buyers and advisors when evaluating credits

Providing comprehensive information up front about the quality of a credit can increase competitiveness and ensure that a newly-listed project gets circulated to the widest audience of buyers via Crux’s automated alerts. Filling out as much detail as possible for a given project helps ensure that buyers have a fulsome (anonymous) picture of the credit and underlying project.

Tax credit sellers are also able to upload details about their track record and high-level financial metrics. On average, sellers on Crux with more robust profiles are more likely to receive bids. The most successful sellers fill out all or most of the fields on their seller profile, including information on:

- Historical production quantities

- Credit rating

- Technologies developed

- Total capacity

2. Be Prepared to Transact

Ultimately, tax credit purchases are primarily economic transactions for the buyer, and they prioritize managing their tax liabilities and mitigating risk through the transaction process. Readiness to transact is one of the most important factors buyers consider, cited by 64% of buyers. Preparing for the transaction due diligence process is a key way to support readiness. Crux research has identified that due diligence and risk mitigation are the most common causes of transaction delays when selling tax credits.

Most common causes of delay or derailment for a tax credit transaction

In May 2024, Crux surveyed 35 of the leading law firms, insurers, tax advisors, and financial institutions in the market to identify the essential due diligence items for a transferable tax credit transaction. From this, we built the industry’s authoritative due diligence checklist, which is available to sellers who list their credits on Crux.

In order to drive an efficient transaction, Crux recommends tax credit sellers prepare the due diligence items that our data indicate are most likely to streamline (or conversely, derail) a deal.

Eligibility and qualification:

- Which tax credit section are you eligible for?

- Do you qualify for a bonus adder(s)? Does the project qualify for a safe harbor?

- Documentation supporting the prevailing wage and apprenticeship (PWA) bonus adder

- Documentation supporting placed in service date

- Seller counsel legal opinion

Basis/excessive transfer risk

- Did the seller calculate the project’s cost basis correctly?

- Is it well-defended by an appraisal?

Recapture

- How will the seller mitigate the risk of recapture? Although Crux’s data indicates that recapture is exceedingly rare (occurring in 0.5% of historical tax credit and tax equity transactions) buyers prioritize mitigating this risk.

For more information on risk mitigation and due diligence in tax credit transactions, download our white paper.

3. Price appropriately

To increase your chances of transacting when selling tax credits, you need to engage competitively. Technology is crucial in this process.

Buyers seek competitively priced credits to manage their tax liability and maximize ROI. 70% of buyers and advisors say they optimize for price when selecting which credits to bid on.

Deal size is an important driver of pricing for both ITCs and PTCs. Pricing tends to vary most across small deals, as recapture and basis risk, relevant chiefly to ITCs, has an outsize role in small credit pricing in a market segment where insurance is difficult or not economically viable to procure.

Crux’s data indicates a variety of factors can influence the pricing of an individual tax credit, including:

- Size

- Technology type

- Seller’s perceived credit quality

- Whether they offer indemnification in addition to insurance

Crux uses these factors to support a transparent market price estimate, including taking in feedback from sellers.

Crux equips all sides of the market with price estimates for each credit, based on data from more than $10 billion in tax credit transactions over the past year. These pricing models are regularly updated with new data points and market trends, and we regularly share them publicly in our Market Reports.

These estimates allow buyers and sellers to align on realistic pricing expectations and drive toward a deal efficiently. For sellers, running a wide, transparent process allows them to optimize their tax credit transfers across price, timing, and other negotiated terms. The data illustrate that competition continues to support deal optimization. In fact, deals that are engaged in a competitive process are 67% more likely than bilaterally-negotiated deals to achieve above-market pricing.

Selling tax credits? Increase your transactability with Crux.

Crux has $12B in supply live on the platform now and has generated over $6B in non-binding bids so far in 2024. For more information on how to make your tax credit transaction more efficient and competitive, get in touch with us.

Additional insights & news

April 4, 2025

This guide examines the differences between tax equity and transferable clean energy tax credits, including the rise of hybrid tax equity structures that utilize elements from both financing structures.

Read More

March 31, 2025

Advanced manufacturing tax credits are among the most in-demand in the tax credit market. Learn what you need to know about these popular credits in this guide.

Read More

March 26, 2025

Beginning in 2025, clean energy projects have access to the new §48E clean electricity investment tax credit and §45Y clean electricity production tax credit. Going forward, developers of new projects need to understand the details of the new tax credits, and tax credit buyers should understand the different qualification parameters under the tech-neutral tax credit regulations.

Read More

.jpg)