A transferable tax credit transaction may be structurally simpler than a tax equity deal, but it is still a complex process and important for buyers, sellers, and their advisers and intermediaries to get it right — particularly for the first transactions in this emerging market.

That’s where Crux comes in. We’re building the ecosystem for transferable tax credits (TTCs): our platform offers the network and tools needed to streamline transactions, access a large market, reduce risk, and increase trust. As TTC transactions begin to accelerate (beyond the few publicly announced deals), here’s what buyers, sellers, and intermediaries can expect in their first TTC transaction with Crux, from initial onboarding through closing the deal.

We can construct an approximate timeline for a transaction by dividing the sale process into a preparation stage and five phases:

For prospective buyers or sellers of TTCs, many considerations can influence the decision to pursue a transaction.

In a recent report, we shared takeaways from our conversations with CFOs and tax executives who are exploring their first TTC transaction. Themes that emerge from these conversations include the attractive economics of TTCs, the opportunity to support sustainability goals, and the relative ease with which buyers can purchase TTCs.

We have also discussed in our comprehensive guide to TTCs some of the attractive elements of a TTC transaction to sellers, including the shortened transaction timeline, the ability to sell credits to a larger group of prospective counterparties (i.e. any corporate taxpayer, not just large institutions capable of supporting a tax equity partnership) and the ability to monetize credits from a wider variety of projects (new technologies, merchant projects, brownfield projects etc.).

Our experienced team of energy, tax, and finance professionals is eager to support our clients’ research into the TTC market. In addition to sharing our market insights, we are happy to engage one-on-one to discuss key considerations and strategies for approaching the TTC market. We’ve also cultivated a network of syndicate partners, advisers, and insurers to whom we are happy to make referrals and recommendations.

The first stage in executing a sale of TTCs is to define the credits that are available for sale:

These are basic questions which most developers have already received guidance on from their teams and advisers prior to listing.

Developers can independently create an account and list their projects and credits for sale on Crux in less than 10 minutes. By listing their project, a developer is promoting their credits to a growing pool of prospective buyers with a digital teaser reflecting key non-confidential information. At the same time, sellers can leverage our digital tools to promote their project to prospective buyers within or outside of Crux.

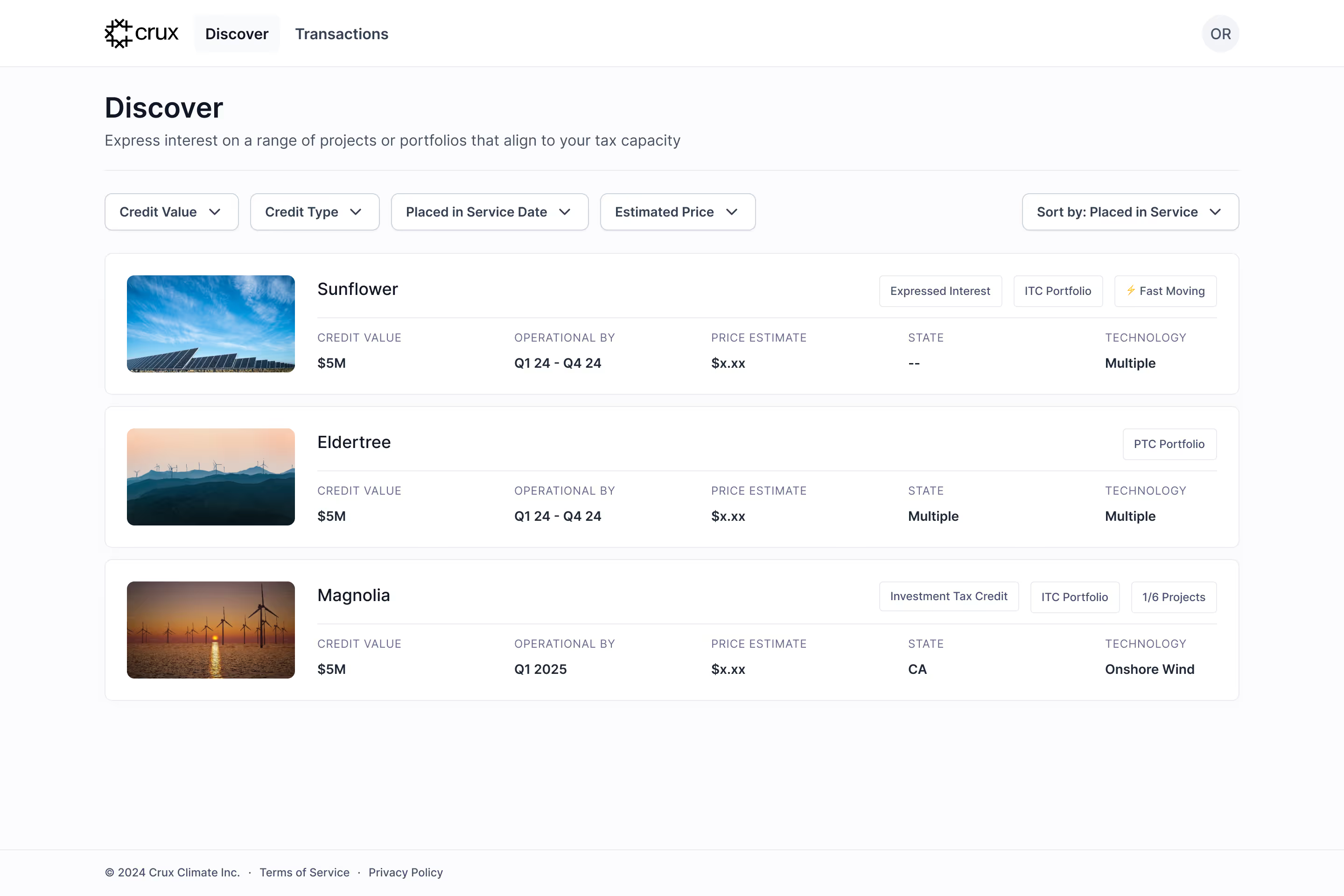

On Crux, buyers and buyer advisors can view the entire market; during this phase, they are browsing for projects tailored to their size, fiscal year, geography, preferred technology type, and other preferences.

Prospective buyers (and their advisers) are able to submit an expression of interest to purchase credits that they discover for sale on Crux. Crux summarizes market averages for credit pricing, so buyers are able to make informed decisions and submit a competitive offer.

Upon receiving an expression of interest, a seller should consider key details, such as:

If a seller determines that the expression of interest is in line with their expectations, both parties will typically execute non-disclosure agreements (NDAs), which entitle the buyer and its advisers to view the project’s confidential data room.

Listing credits on Crux is one channel to accelerate the transaction process, and we encourage sellers to invite prospective buyers and their advisors onto the platform to facilitate collaboration.

After buyers and sellers have executed their NDA, sellers are able to grant prospective buyers access to their project’s confidential information. Parties will then begin negotiating the term sheet for TTC sale. This process can take a couple of weeks depending on parties’ level of preparedness and preferences. Either during this negotiation, or, perhaps more commonly, once the term sheet is signed, the buyer side will begin conducting due diligence. Due diligence is an important step for obtaining insurance coverage (if required) and for protecting the buyer from certain penalties.

Negotiating a term sheet will typically occur with input from advisors and legal counsel, all of whom are able to collaborate in Crux at the invitation of buyers and sellers. Leveraging Crux as a single source of truth for all parties can support a timely negotiation process and move buyers and sellers closer to the next stage quickly.

We note that the US Treasury in its draft guidance (page 102) has indicated that buyers who conduct due diligence are able to avoid certain penalties in the event of credit recapture or dispute on eligibility and value. As such, buyers of ITC credits in particular will be expected to, at a minimum:

Crux is designed to streamline the process of information disclosure and diligence while reducing risk for stakeholders. Our team has developed a thoughtful standard data room infrastructure reflecting the most common due diligence requirements, so buyers and their advisers can more easily locate information. Our team has invested in standardized forms and documentation, allowing Crux to facilitate the transaction process and reduce the administrative burden for future transactions. Finally, Crux is built for collaboration—we encourage buyers and sellers to invite their advisors to the platform to improve the ease of information exchange.

More and more deals are approaching the finish line as this market continues to take shape. The IRS requires payment for TTCs to be made in cash, so we consider a deal to be closed once it has been funded. However, there are additional requirements that parties must meet to comply with IRS regulations.

In order for a buyer and seller to execute a transaction in TTCs, the IRS requires the parties to follow a particular process, as outlined in our comprehensive guide. Projects need to submit a pre-filing application, and both the buyer and seller must complete a transfer election statement, which is filed with their taxes. For multi-year deals, this process must be completed annually, and Crux can serve as an essential hub for annual exchange of information necessary to complete tax filing.

In addition to streamlining the process of listing TTCs for sale and facilitating transactions with standardized documentation, datarooms, and a collaboration-ready environment, Crux can also help sellers by: