The evolving market for transferable energy tax credits (TTCs), created with the passage of the landmark 2022 Inflation Reduction Act, creates new opportunities for companies, their CFOs, and tax directors to optimize their tax strategies. Demand for TTCs is rising rapidly, particularly for 2023 tax liabilities, spurred by favorable regulatory guidance (for more information of the current state of the market, check out last week’s deep dive).

To capture the dynamism of the market today, we’re highlighting some recent conversations with clients – CFOs and tax executives across industries – as they evaluate and pursue their first TTC transactions. Most firms are no longer wondering whether to purchase TTCs – now it’s a question of when, how, and which TTCs to pursue.

A growing list of CFOs and tax executives are actively preparing to transact in the burgeoning market for TTCs: finalizing their understanding of transaction structures and economics, getting approvals, and exploring specific deals. We often see leaders taking five steps to make sure that they’re identifying and ultimately pursuing the right opportunities.

First, executives are placing increased attention on TTCs. CFOs and tax directors are hearing about TTCs from a variety of sources: law firms and accounting firms, in particular, but also their peers, banks, industry associations, and the media are keeping TTCs in the conversation.

Further, many power deals being done today offer attractive economics. Pricing on the buy side for many transactions falls in the range of $0.90-$0.95 per dollar of tax credit, though factors like project risk, developer credit, technology type, portfolio makeup, and insurance can materially affect price.. Competitive market pricing and transparency help CFOs to discern whether, and which, TTCs belong in their firms’ tax strategies.

As the CFO of a regional bank put it recently, “I've spoken to other tax directors, other banks as well, CFOs, and some of the bigger banks have said to me, we're getting a nice return on these energy tax credits. This is an important new tool for managing our tax liability while investing in sustainability.”

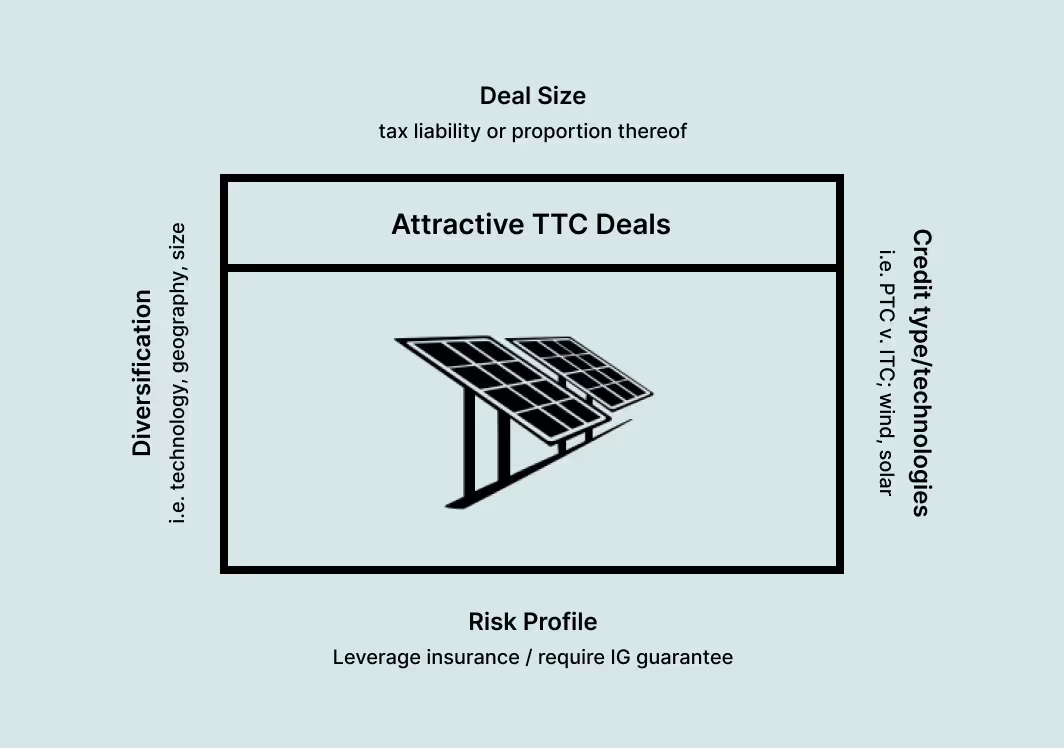

Second, CFOs and tax executives are getting internal approvals and designing the “box.” Firms are building their “box” – defining the TTC deals that fit their ownership, tax, and risk profile. These boxes have four key “walls,” or criteria: desired deal size and timing, diversification, technologies, and the firm’s assessment of risks, including the types of counterparties they want to transact with and use of insurance. As firms are building their “box,” some are taking the added step of drafting audit- or board-approved tax credit policies.

Even within a given firm, there may be internal differences regarding these criteria. In a recent conversation, the Treasurer of a leading industrial manufacturer noted, “Some members of our executive team are perhaps willing to transact a deal that is relatively risk-free, but others want to see a ‘home run,’ something that maybe prices lower but offers a bigger return.”

Third, people are building their deal team. The “deal team” includes a number of advisors. Most firms lack the internal resources to manage sourcing, diligence, and transaction execution so they are building a team that includes platforms and partners like Crux, tax advisors, and law firms to execute deals. As the CFO of a regional bank noted, “My department is a department of two. It's one colleague and me, and we handle our tax credits for the entire bank. And some of these programs are regulated. Some of them require a lot of compliance and follow up. So when I heard about Crux, I was like, ‘I’m in. This can make my life easy.’”

A key consideration for the deal team hinges on how to conduct diligence. Recently, the CFO of a national retail business asked our team, “Who are most buyers going through to do their due diligence?” While law firms and CPAs provide one aspect of diligence, Crux also conducts an initial screening of projects to ensure that the projects listed on our platform meet a quality threshold. Beyond that point, our clients turn to their tax advisors and lawyers to provide reliance for their due diligence work.

Fourth, many executives are finding that funding their TTC transaction is feasible and relatively straightforward. TTCs can provide an option for CFOs to reduce tax costs within organizational constraints around lending and investment. In particular, TTCs generally don’t obligate any additional cash to be set aside, as most corporations are timing their transactions to quarterly estimated tax payments. Additionally, they don’t require carrying an investment on the balance sheet.

These characteristics were a welcome change to the CFO of a privately held pharmaceutical manufacturer during a recent call. After noting that financial covenants and constraints restricted their investment in tax equity deals, they shared, “With the transferability provisions, we're not participating in a partnership structure. We're just buying credit. So that may be more compatible with our lending terms and conditions.”

Buying TTCs isn’t a decision between building a new factory or buying tax credits – it’s using funds already set aside to generate an incremental return and support sustainability objectives.

Finally, firms are planning their first transactions. The market for TTCs is evolving rapidly and firms are actively identifying and moving forward with deals that suit their unique circumstances. Taxpayers with variable or lumpy quarterly or annual tax payments may not have historically had enough visibility into tax liabilities to participate in the tax equity market. These corporate buyers are learning that the flexible and nimble TTC market offers an opportunity to save on tax costs, including in 2023, for firms that can move quickly.

As the CFO of a privately held firm with disproportionately large 4th quarter revenue put it, “Because of the variability of our profit, [our TTC transaction] would probably be one or two of the larger purchases… we don't have the profitability this quarter, but in the fourth quarter, it's going to be through the roof.” By engaging with Crux early, this firm has an opportunity to defray their higher expected tax liabilities in the fourth quarter.

Buyers of TTCs can define the contours of the deals they want to see, but the market will define two important criteria: deal price and timing of delivery. Market pricing can be very attractive today. However, timing for TTC delivery is a function of the supply of TTCs for a given quarter – as the third quarter drags on, the supply of available TTCs to offset third quarter estimated tax payments is growing tighter. And while deal timelines are much shorter than for tax equity deals, it can still take several months from discovery to close.

It is likely that we will see an end of year supply crunch – meaning that buyers entering the market in November may not be able to successfully close 2023 deals. Especially as it pertains to utility-scale projects, supply of 2023 TTCs is growing tighter, and buyers who wish to defray 2023 tax liabilities are increasingly looking at building portfolios, including of residential rooftop or commercial and industrial projects.

We’re ready to walk you through the available projects and help you build your strategy for taking advantage of the TTC market. If you’re ready to get started, get in touch today.