Is the juice worth the squeeze? Whether a company is newly approaching the prospect of purchasing clean energy tax credits to manage their tax liability, or whether they’re actively engaged in this multi-billion dollar market, the question is a common one: what does a tax credit buyer stand to gain? Energy tax credit transactions are not riskless, and while the risks can be managed, buyers want to understand the benefit of taking on a transaction in the first place. Today, we outline several measures of economic return which companies commonly use to measure the impact of tax credit purchase.

When Congress passed the Inflation Reduction Act (IRA) in 2022, authorizing tax credit transferability for the first time across 12 different clean energy tax credits, it intended first to create an economic incentive for companies to invest in these projects and thereby drive efficient capital allocation to clean energy. That is to say — purchasing clean energy tax credits is an economic decision that drives a positive (and often significant) return on investment (ROI).

There is more than one way to think about the value that a tax credit purchase can drive for a company. Below, we outline several common approaches, from ROI to internal rate of return (IRR) and expected total return (ETR), as well as how these measures may be utilized to assess the attractiveness of several common scenarios.

A return on investment is a straightforwardly simple concept. The proceeds from an investment divided by the cost of an investment yields a percentage ROI.

In the context of a tax credit transaction, the proceeds from the investment can be understood as the difference between the face value of the credit and the price paid for the credit (per dollar). Tax credits are typically quoted in cents on the dollar, and the average credit price in 2023 was between 92 and 94 cents per dollar of face value. One of the first details that buyers and sellers align on in the course of a transaction is the price that will be paid for the tax credits.

Buyers and sellers must align on other terms, too. Timing of payment, in particular, is an important consideration which comes to bear when calculating the return from an investment in tax credits. Thoughtful buyers, however, can also leverage timing of payment in order to drive incremental value from a transaction — for both parties. IRR measures the benefit of a transaction adjusted for timing. IRR can be extremely high for tax credit buyers who time their transactions around their tax filing dates. For companies that make quarterly estimated tax payments, they earn a ROI four times over the course of a year — and IRR is effectively multiples of the transaction ROI.

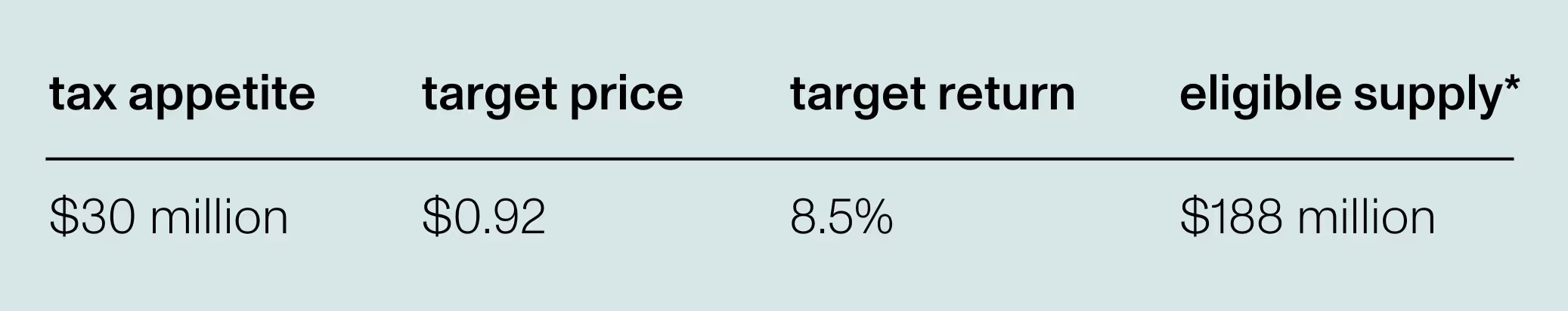

Many buyers will execute several transactions throughout the year. ROI for each transaction will differ, depending on price and timing of payment. ETR aggregates the returns from different transactions to achieve a blended total return. For buyers targeting a particular return, this strategy can substantially increase the supply of credits meeting their specifications. For example, a buyer seeking to satisfy $30 million of their tax liability with tax credits and targeting a price of 92 cents will have many options. Of over 500 projects totalling more than $8 billion in credits available on the Crux platform, more than a dozen meet this exact specification. However, broadening the scope of the buyer’s aperture significantly increases the supply of desirable projects.

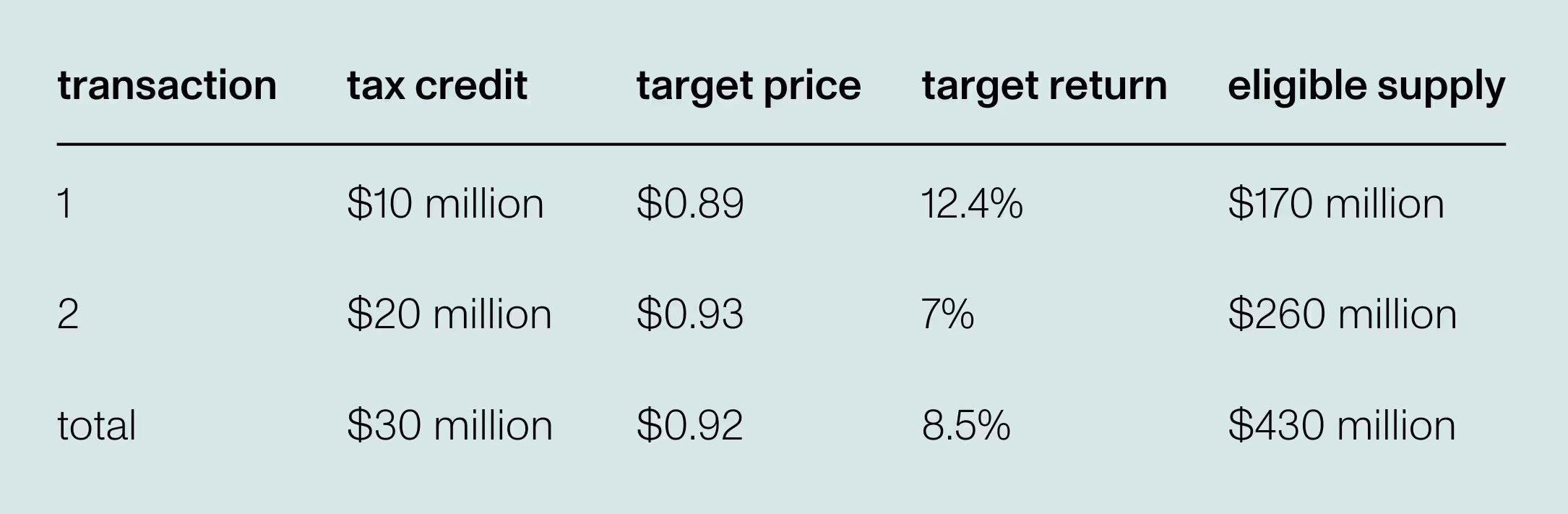

Buyers can achieve a similar total return by purchasing one tranche of credits at a lower-than-target price and another at a potentially higher-than-target price. In the example below, we illustrate how the supply of 2024 credits increases dramatically with this flexible approach.

Option 1: meet tax appetite and target return with single transaction

Option 2: achieve tax purchases and ETR through multiple transactions

Broadening the aperture of projects to consider significantly increases the supply of credits that the buyer can evaluate, and provides diversification options in the event that they are unable to execute a single transaction within the target price and deal size range.

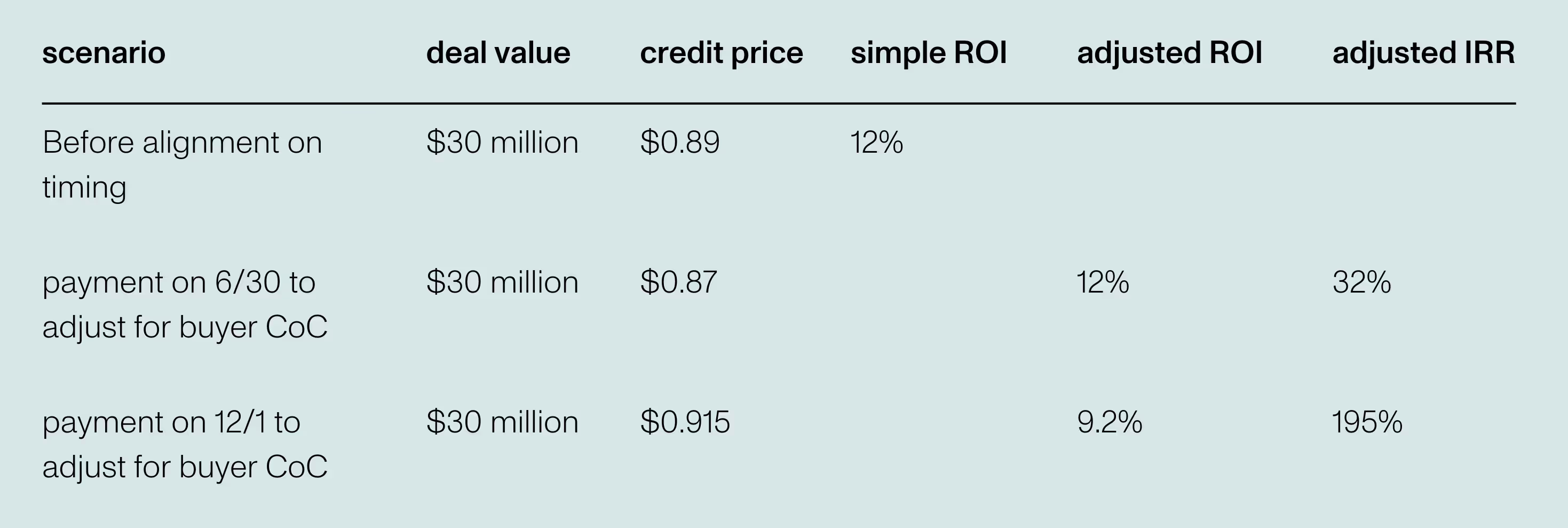

In our first scenario, a buyer purchases tax credits from a seller to satisfy their entire annual tax appetite, and pays for these tax credits at one time. Timing of payment influences the buyer and seller’s total return, with sellers often advocating for earlier payment timing and buyers typically aiming to align payment with their tax payment. Material payment timing differences can typically be settled by adjusting the purchase price.

A company that files its taxes annually on December 31 identifies a $30 million investment tax credit (ITC) from a bioenergy producer. The seller has listed the credits for89 cents, which would yield a 12% simple ROI for the buyer. However, the parties are not aligned on the timing of payment.

The project will enter service on June 30, and the seller wants to receive payment aligned to their in-service date, at which point they are refinancing their project’s loan. However, the buyer may not have cash available to make the payment six months before their tax filing deadline.

There are several ways to address this timing discrepancy. The buyer and seller can adjust pricing to reflect their relative costs of capital and adjudicate the timing difference through the deal price. It is also becoming increasingly common for lenders to advance loans to bridge the difference between when a tax credit is paid for or received and when it is used. In the case of a bridge loan, the seller may choose to take payment in December at a higher credit price, but can also access a short term loan to still align cash flow with their in service milestone.

For purchases of production tax credits (PTCs), particularly on a spot (annual) basis, it is common for buyers to pay in quarterly installments for tax credits generated during the preceding quarter. These payments can be out of sync with a buyer's tax liabilities. Nonetheless, arranging timing for payments on a quarterly basis can drive a significant IRR for a tax credit purchase.

For a taxpayer who aligns their tax credit payments with their tax filings, IRR can become, effectively, infinite. Even credit buyers with lumpy tax payments (say, clustered towards the end of the calendar year), can still expect to record a IRR in the high double digits — 80%-100% on the transaction.

Quarterly payments are very popular among buyers, unsurprisingly, and typical spot PTC pricing reflects this reality. We tend to observe that spot purchases of PTCs command the highest pricing, often mid-90s.

An alternative option for buyers seeking a higher ROI on tax credits would be to pursue quarterly purchases of ITCs, aligned more or less with a company’s tax filing deadlines. ITCs, particularly in smaller notional values, tend to price lower than spot PTCs — the mid-to-high 80s and low 90s — offering a higher real return on each transaction. Multiple transactions require foreplanning and due diligence, but are popular for buyers who endeavor to maximize their returns.

The calculator presents a simple ROI and net cash return based on target total return. Tax credit purchases, as depicted above, can have a wide range of structures, and the calculator uses a fixed time value of money (tied to the risk free interest rate) to estimate how timing and structure can influence a buyer’s total return and IRR.